Home Insurance In Dallas Tx for Beginners

Wiki Article

Our Health Insurance In Dallas Tx Statements

Table of ContentsThe Only Guide to Home Insurance In Dallas TxHow Home Insurance In Dallas Tx can Save You Time, Stress, and Money.Health Insurance In Dallas Tx Fundamentals ExplainedLittle Known Facts About Commercial Insurance In Dallas Tx.

There are various insurance coverage, as well as knowing which is best for you can be challenging. This guide will certainly talk about the various types of insurance coverage and what they cover. We will certainly additionally supply suggestions on choosing the ideal plan for your needs. Table Of Material Health and wellness insurance coverage is one of the most important kinds of insurance policy that you can have.It can cover routine check-ups in addition to unanticipated diseases or injuries. Travel insurance policy is a plan that gives economic protection while you are traveling. It can cover trip cancellations, lost travel luggage, medical emergencies, and other travel-related expenses. Travel medical insurance coverage is a plan that specifically covers medical costs while traveling abroad. If you have any questions concerning insurance, contact us and also request a quote. They can help you select the ideal policy for your needs. Thanks for reading! We hope this overview has been handy. Get in touch with us today if you want customized service from a certified insurance representative. At no cost.

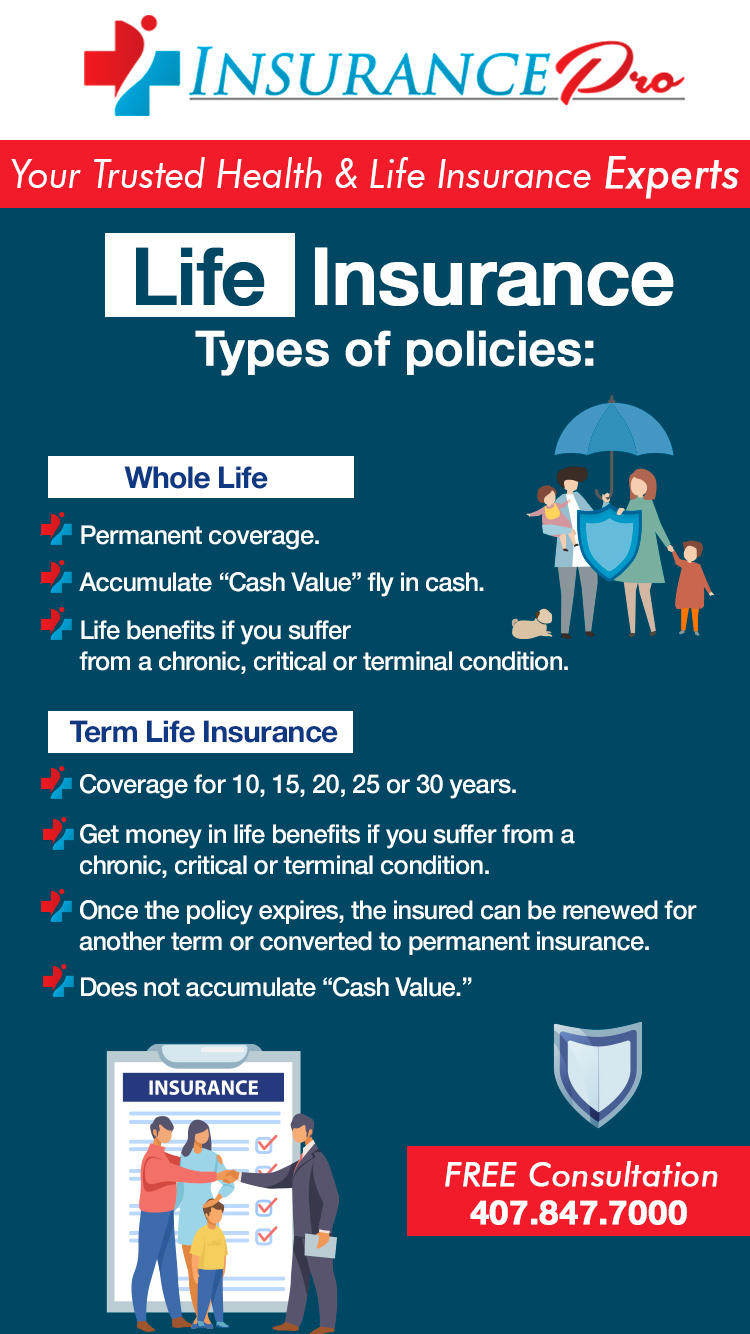

Below are a couple of factors why term life insurance coverage is the most prominent kind. The expense of term life insurance policy costs is determined based on your age, wellness, and the coverage quantity you call for.

With PPO plans, you pay higher regular monthly costs for the liberty to use both in-network as well as out-of-network companies without a reference. Paying a costs is similar to making a regular monthly auto payment.

The Facts About Life Insurance In Dallas Tx Revealed

When you have a deductible, you are accountable for paying a certain amount for insurance coverage solutions prior to your health insurance plan provides coverage. Life insurance coverage can be divided right into two primary types: term and also permanent. Term life insurance policy provides protection for a particular duration, commonly 10 to three decades, and also is extra economical.We can't avoid the unanticipated from occurring, however sometimes we can protect ourselves as well as our households from the worst of the monetary after effects. Four kinds of insurance policy that a lot of monetary professionals suggest consist of life, health and wellness, automobile, as well as long-lasting special needs.

It includes a survivor benefit as well as also a money value component. As the worth expands, you can access the cash by taking a car loan or withdrawing funds and you can finish the policy by taking the money worth of the policy. Term life covers you for a set quantity of time like 10, 20, or 30 years and also your costs remain steady.

2% of the American population was without insurance protection in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Health And Wellness Stats. More than 60% obtained their insurance coverage via a company or in the personal insurance policy industry while the remainder were covered by government-subsidized programs consisting of Medicare and also Medicaid, professionals' benefits programs, as well as the government market developed under the Affordable Treatment Act.

Insurance Agency In Dallas Tx - Questions

Investopedia/ Jake Shi Long-term disability insurance policy sustains those who become incapable to function. According to the Social Safety and security Administration, one in four employees going into the workforce will certainly become disabled before they get to the age of retirement. While wellness insurance coverage spends for hospitalization and also clinical costs, you are often burdened with all of the costs that your income had covered.

Virtually all states require motorists to have auto insurance policy as well as minority that don't still hold chauffeurs monetarily accountable for any read damage or injuries they cause. Here are your choices when purchasing auto insurance coverage: Obligation protection: Spends for residential or commercial property damages as well as injuries you cause to others if you're at mistake for a mishap as well as likewise covers lawsuits expenses and judgments or negotiations if you're sued due to the fact that of a car crash.

Company protection is often the most effective choice, yet if that is inaccessible, get quotes from numerous companies as many give price cuts if you acquire more than one sort of coverage.

Truck Insurance In Dallas Tx - An Overview

, as well as exactly how much you want to pay for it., their pros as well as disadvantages, just how long they last, and that they're ideal for.

This is one of the most popular kind of life insurance policy for many people because it's cost effective, just lasts for as long as you need it, and features few tax policies and restrictions. Term life insurance policy is one of the most convenient and least expensive ways to give a financial security web for your loved ones.

You pay costs toward the policy, and also if you pass away during the term, the insurance policy company pays a set amount of cash, recognized as the death benefit, to your designated recipients. The fatality advantage can be paid out as a round figure or an annuity. Lots why not check here of people choose to receive the death benefit as a round figure to avoid paying tax obligations on any kind of gained passion. Life insurance in Dallas TX.

Report this wiki page